Customers Addicted to Coupon Deals

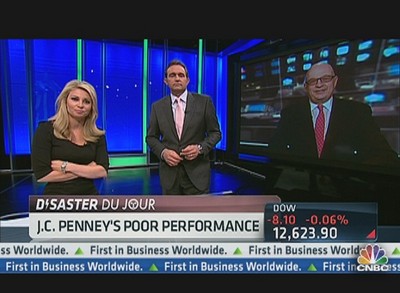

Just when you thought JCPenney expectations might be low enough? Nope. Not even close. Turns out the American consumer is addicted to a deal.

|

|

Ryan T. Conaty | Bloomberg | Getty Images

|

The problem is the JCPenney management team did not realize just how much their customer is addicted to the coupon drug. Weaning them off their addiction looks like a bigger challenge than Ron Johnson had originally anticipated.

Same-store sales for first quarter plunged 18.9 percent and the reported loss was more than two-times expectations.

Customer traffic was the main issue, and for the foreseeable future, I am not sure why that would change. Traffic declined 10 percent. High-traffic weekends were simply not high traffic, and the number of shoppers in the stores fell 12 percent year-over-year. Notably weekends tend to be more skewed to the bargain-hunting coupon wavers.

Weekday store traffic was down a kinder 6 percent, but that did not exactly make investors feel any better in the packed-out venue where the post-mortem earnings meeting took place.

The trend in sales throughout the quarter also did not make us feel any better. February's sales fell 21 percent and improved by 300 basis points for March/April. The company also pointed out conversion rates only declined 100 basis points to 21 percent from 22 percent, not so bad at a time when consumers may be confused by pricing and signage changes in the stores. (Now that is making lemonade out of lemons.)

Also, it turns out the marketing message may not be getting across. While having fewer promotions may save the company plenty of dough — repricing store signs alone was costing $50 million per year as there were 590 of them last year — customers are still driven into stores by the promise of a deal.

The advertised "best price friday" has not resonated as expected with consumers. In fact, customers might have mistakenly thought Friday was their only shot at a sale. As a result, the marketing message will be changed to "the big deal starts today." The company will now highlight the new discounted price versus the prior message of everyday low prices.

Not surprising, sales of "basics," such as underwear and socks, have suffered. When it comes to fashion, consumers are willing to pay up, but when it comes to basics, pricing rules. While in the end, JCPenney's consumers may not be paying more than they used to with everyday low pricing, the lack of in-your-face promos is a case of perception is reality.

While JCPenney tells us the transformation is ahead of schedule, the bottom line is sales are not. Cost cutting — and there is plenty of it in this story — is low-hanging fruit. Cost opportunities will now exceed the previously announced $900 million, although they won't tell us by how much. The problem is cost-cutting stories have a shelf life (flashbacks of RadioShack [RSH 4.34  -0.04 (-0.91%)

-0.04 (-0.91%) ![]() ]).

]).

Over the longer term, keeping the core consumer and/or capturing the new, younger consumer is key. While we are early in the transformation game, so far it appears JCPenney's changes are alienating the core and not attracting the new. While brands may change, it is clear this will not happen overnight, and certainly not this year.

While JCPenney wowed us with new brands in the pipeline — Cynthia Rowley, Tourneau, Michael Graves, Betsey Johnson, Vivienne Tam, Lulu Guiness, a hip JCPenney-looking brand pipeline, broader Nike product and fancy looking stores-within-a-store — the question is how long will investors wait? This transformation will take time, and today investors are showing their lack of patience.

Source:http://www.cnbc.com/id/47440277

.